AI has shifted the ground under SaaS. Cloud tailwinds are fading, capital is selective, and AI native entrants are well funded. If your company is not AI-first, you can still raise and win. You need a sharper equity story rooted in fundamentals, a credible AI lens, and a plan that creates outcomes your customers will pay for.

This article distills investor Björn Beckman’s perspective from Verdane into an operator-ready guide for founders and revenue leaders preparing to raise in 2025.

The market reality you must acknowledge

- Cloud software is no longer a guaranteed growth trade. Over the last three years, the Nasdaq Emerging Cloud index underperformed the S&P 500 by roughly forty percentage points. Tailwinds from on-prem replacement and Excel automation are largely absorbed.

- AI is the headline. Last year, AI companies attracted about one-third of global VC funding, roughly eighty billion dollars. Expect that to rise.

- Capital still flows to proven builders. Verdane closed a two billion euro fund in six months. Professional investors are active, selective, and data-driven.

Translation for operators. You will not be graded on AI buzzwords. You will be graded on durable fundamentals and on how AI strengthens them.

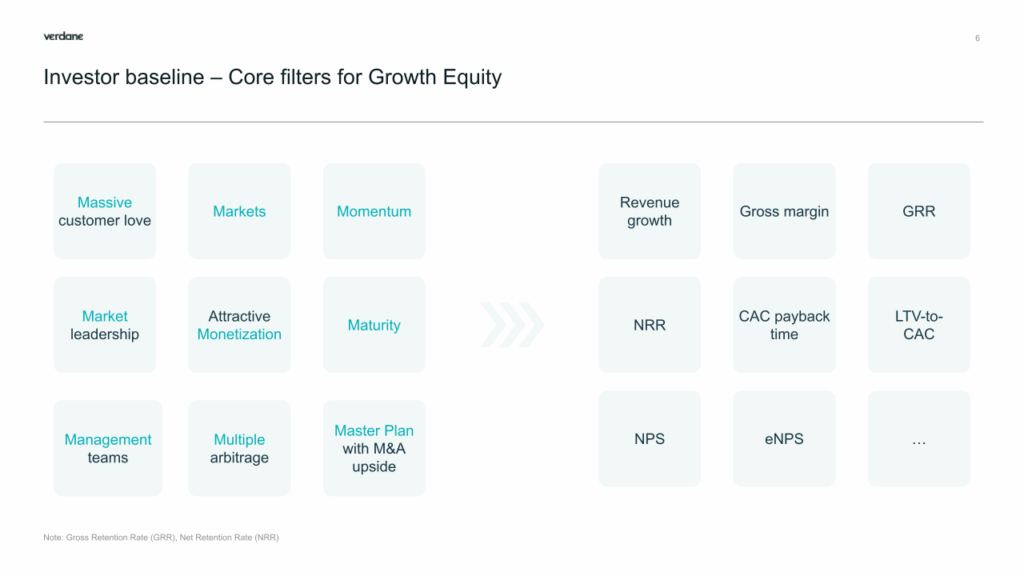

Verdane’s 9 Ms: the baseline investors still use

AI adds a lens. It does not replace fundamentals. Verdane evaluates scale-ups using a simple framework:

- Massive customer love

- Market with secular growth

- Momentum

- Market leadership or a clear path to it

- Monetization that captures the value you create

- Maturity to control your destiny

- Management that is ambitious and credible

- Master plan that is viable and clear

- Multiple opportunities at exit

Claims must be quantified. High customer love shows up in NPS, CSAT, net and gross retention, usage depth, and expansion rates. Momentum shows in new ARR, win rates, sales cycle, and stage aging. Maturity shows in rule of 40, cash efficiency, and unit economics that scale.

Typical scale for growth equity entry. Five to ten million euros in ARR as a floor, with faster growth offsetting smaller bases, and slower growth requiring larger bases.

What AI changes at the macro level

Think regime shift, early innings. Winners and losers will emerge.

Opportunities:

- New growth vectors. Products, services, and pricing models that did not pencil before may work now.

- Lower cost to serve. Productivity gains across product, success, marketing, and G&A.

- New categories. AI native entrants challenge incumbents and expand buyer budgets.

Risks:

- Lower barriers to building. The marginal cost of software creation drops. Pure technical complexity is a weaker moat.

- In-house alternatives. Enterprises assemble solutions on top of foundation models and low-code. Point solutions that cannot prove differentiated outcomes risk commoditization.

Your equity story must place you on the right side of both lists.

What AI changes at the micro level

Re-examine your moats. Some strengthen. Others weaken.

Weaker:

- Technical complexity as a moat. If competitors can replicate features faster and cheaper, speed alone will not defend you.

- Behavioral stickiness from learned workflows. Human software hopping gives way to agent-style interactions and orchestration across tools. The UI layer is less defensible.

Stronger:

- Proprietary data that others cannot access or easily recreate.

- Domain expertise that contextualizes models and data for specific, high-value problems.

- Network effects that increase utility with each participant and raise switching costs.

Investors favor moats that get stronger as AI spreads, not weaker.

Shift from features to outcomes

Customers do not buy technology. They buy outcomes. AI accelerates this shift.

Move from selling tools to delivering results.

- From “software for customer service reps” to “resolution with quality and time to value guarantees”

- From “threat monitoring dashboards” to “managed containment with contractual MTTR”

- From “workflow builders” to “agentic execution that completes the workflow end to end”

This is Levitt’s lesson for 2025. Railroads failed when they thought they sold trains instead of transportation. Do not define yourself by your current UI or feature list. Define yourself by the job you complete.

What to bring to an investor meeting in 2025

1) A fundamentals-first narrative, proven in numbers

- Customer love. NPS, gross retention, NRR, adoption depth, activation speed, cohort curves.

- Unit economics. CAC payback, LTV to CAC, contribution margin by segment, sales cycle, and win rate by ICP.

- Cash discipline. Rule of 40, burn multiple, trajectory to self-funding.

2) A credible AI lens that improves those fundamentals

- Data advantage. What proprietary data do you own or can aggregate? How it compounds model accuracy and defensibility.

- Outcome lift. Measurable gains in time to value, resolution time, accuracy, or unit cost. Early proof points beat roadmaps.

- Business model impact. How AI enables new packaging, usage meters, margins, or service attach without diluting gross margin quality.

- Moat evolution. Why does your moat strengthen as models get cheaper?

3) A go-to-market plan built for a mature category

Not every market will support triple triple double double. If you play in a replacement market, plan for ten to thirty percent growth with a profitability path. If you are creating or redefining a category, show how you capture share fast with sensible cash efficiency.

4) Evidence that you control your destiny

- Repeatable sales motion with clear ICP and qualification.

- Efficient onboarding with time to first value tracked and improved.

- Pricing and packaging tested with real cohorts.

- Hiring plan aligned to productivity, not headcount vanity.

Building an AI-ready moat: practical moves for the next two quarters

- Codify your proprietary data. Map sources, permissions, refresh cadence, and quality. Secure rights in contracts. Package data assets that improve outcomes for customers, not just your models.

- Productize outcomes. Offer tiers that guarantee specific results. Add design patterns for agent handoffs, exception handling, and human in the loop so buyers trust adoption.

- Reprice what AI changes. Remove price walls that slow adoption. Add usage meters where the value scales with compute-intensive actions. Anchor with platform value so margins remain predictable.

- Retool success around impact. Instrument outcomes in the product. Publish customer impact scorecards in QBRs. Tie renewals and expansions to realized results.

- Narrate the moat. Teach your market how your domain expertise, data, and network ties compound. Make the story simple enough for a Board memo and specific enough for a technical diligence call.

How to position if you are not AI first

Be precise and pragmatic.

- Acknowledge the shift. Investors do not reward denial.

- Show selective leverage. Use AI where it improves the customer’s outcome or your unit economics. Avoid the theater.

- Own a specific job. The narrower the job and the richer your data, the stronger your advantage versus generalists.

- Partner where it helps. Use best-in-class models and tooling. Focus your talent on the last mile and the data that only you can assemble.

What good looks like in growth equity

- Five to ten million ARR or more, clean cohorts, and a path to profitable growth

- Clear ICP with strong win rates and rational CAC payback

- Net revenue retention above one hundred percent and improving

- A moat thesis tied to data, domain, and network effects

- An AI plan that creates measurable outcome lift and better margins

- A leadership team that can explain this in ten slides and defend it in diligence

Final takeaway

You do not need to be an AI-first company to raise well in 2025. You need to be a fundamentals-first company with an AI lens that strengthens your moat, improves outcomes, and clarifies how you win. Avoid railroad thinking. Define yourself by the outcome your customers buy, then use AI and data to deliver that outcome faster, cheaper, and more reliably than anyone else.

Watch the full session from SaaSiest Amsterdam 2025 here.