What is the real problem and why it matters now

For years, SaaS pricing followed a familiar rhythm: undercharge to win customers, learn where value concentrates, build more for that group, raise prices, and repeat. It was predictable, scalable, and profitable.

Until now.

In the age of AI, that old playbook no longer works. Model costs are not dropping fast enough, customers demand access to the best, and token volumes are exploding as products adopt reasoning and agentic capabilities. Margins that once held steady in software are collapsing under new cost structures.

Kyle Poyar, Founder and author of Growth Unhinged—one of the most-read pricing and growth newsletters—has spent his career helping over 100 software and AI companies navigate these shifts. With experience from global pricing consultancy Simon Kucher and fresh data from a survey of more than 240 companies, he’s mapped how monetization models are evolving and what will define pricing power in the years ahead.

At SaaSiest Amsterdam, Kyle shared his six rules for monetizing in the AI era—a practical framework for SaaS leaders to adapt fast, protect margins, and align pricing with customer value.

The six rules of monetization in the age of AI

Rule 1: How you charge shapes willingness to pay

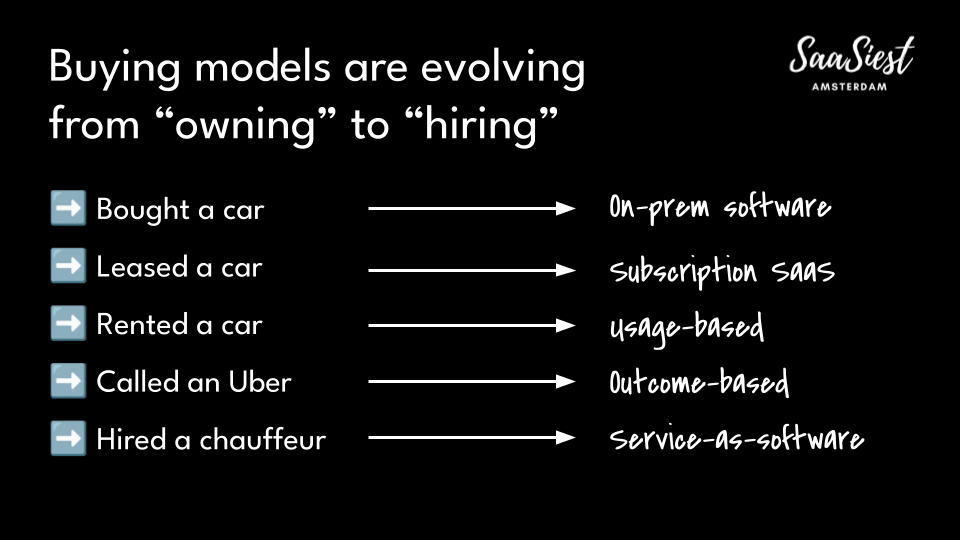

Think about a ride from point A to point B. You can buy a car, lease, rent, book an Uber, or hire a chauffeur.

Each option is an analogy that maps to a different software model.

On-premise is buying.

Subscription is leasing.

Usage is renting.

Outcome-based is Uber.

Service-as-a-software is the chauffeur.

Shifting the model can unlock pricing power. With SaaS we paid less upfront but more over time for products that delivered results. That forced vendors to invest in product and customer success to earn renewals and lifetime value. In on-prem models, vendors often captured around 5 percent of the value created. With success-based models, companies can capture 25 percent or more because they take on more risk, align to outcomes, and give customers flexibility.

Takeaway: Your model is a growth lever. If customers pay when they win, they will often pay more. The job is to align price to where value is proven and risk is shared.

Rule 2: Learn the flavors and choose with intent

AI pricing is not one size fits all. Kyle simplifies the chaos into five families:

- Flat fee subscription

- Seat-based

- Hybrid platform or seat fee plus usage or credits

- Pure usage

- Outcome-based

Each has tradeoffs. Seats can be simple to forecast and easy to sell into existing budgets. Usage aligns with activity but can create bill shock. Outcome-based can maximize willingness to pay but raises hard questions on attribution and predictability.

There are design tools to de-risk any model: spending caps at account or user level, annual drawdowns for seasonality, rollover allowances to smooth spikes, and platform fees that anchor value while metering expensive actions.

Takeaway: Do not shop for a model on LinkedIn. Shop for a model in your customer’s workflow and in your cost structure. Use design controls to protect predictability.

Rule 3: Avoid flat fees unless your margins are near bulletproof

Flat fees are easy to explain and invoice, but they are dangerous when unit costs vary with usage. MoviePass promised unlimited movies for a single monthly price. It exploded in growth, then exploded in losses, then shut down.

Kyle’s survey shows why many teams are exposed. A year ago the most common model was still flat fee, followed by seats, usage, and a small share of outcome-based. Flat fees overcharge smaller customers, undercharge your biggest power users, and remove upsell paths. If you rely on a flat fee, build at least two upsell levers such as product tiers plus a usage meter for expensive actions.

Takeaway: if your COGS scales with use, your price must scale with use. If you keep a simple envelope price, make sure there are metered add-ons or tiered thresholds inside the envelope.

Rule 4: Use credits as a bridge to value-based pricing

Credits are everywhere because they are flexible. A plan includes a baseline number of credits. Different actions consume credits at different rates. New features can be monetized by adjusting conversion rates without rewriting the entire price page. That is why hybrid models jumped from roughly one quarter of companies to roughly two fifths in Kyle’s dataset within a year.

There is a catch.

Enterprises struggle when every vendor uses credits with different conversion rules. Procurement wants predictability across a portfolio, not just inside your SKU.

Credits are useful now. Value-based pricing is the destination. The more you can tie price to measurable value moments, the more you can scale revenue with impact rather than with raw activity.

Takeaway: start with credits to meter cost drivers and learn usage. Build telemetry to connect those credits to outcomes your buyers already measure. Migrate pricing language from credits to value moments over time.

Rule 5: Have the pricing talk with your customer

Outcome-based pricing works when four conditions are true:

- Outcome consistency. Customers seek a similar, well-defined result.

- Attribution clarity. You align on the definition of success and how to measure it up front.

- Measurement in product. Success is visible in near real time without manual work from the customer.

- Predictability. You can credibly estimate success rates so finance can budget.

Chargeflow is a good pattern. No SaaS fee. They integrate with Stripe or Shopify, dispute chargebacks, and take a cut of recovered revenue. Clear outcome, clear attribution, and clear math.

Intercom’s evolution shows the other side. Charging on resolutions is powerful, but it forced tough conversations on whether the bot or the agent delivered the outcome and what the success rate would be. As performance improved, the model became more predictable, yet the need for transparency never went away.

Takeaway: Test outcome-based offers where your product controls the work, proves the result, and predicts the range. Use a hybrid model elsewhere so you keep trust and forecastability.

Rule 6: Build pricing agility into your operating system

Your pricing will change within 12 to 18 months. Plan for that today.

- Design for optionality. Avoid locking into multi-year, all-inclusive deals without expansion paths.

- Decide ownership. Assign a pricing owner who runs a cross-functional process, gathers customer input, and brings decisions to an executive steering group.

- Instrument the KPIs. Track the impact of changes on win rate, time to close, average revenue per account, churn, and gross margin. Do a post-mortem after every change.

- Modernize the stack. Choose billing and metering platforms that can handle hybrid meters, credit rollovers, and plan migrations without engineering heroics.

Takeaway: The cheapest time to change pricing is now. Every quarter you delay adds organizational scar tissue.

A step-by-step playbook for scale-ups

Use this 90-day plan if you are between 2 million and 200 million ARR.

Weeks 1–2: Cost and value mapping

- Quantify unit costs for AI features. Break down model costs by action, context window, and reasoning depth.

- Identify three to five high-value customer outcomes already measured in QBRs.

- Run a power-user audit. Are your top 10 percent of users profitable at current prices? If not, why?

Weeks 3–4: Model design options

- Draft three model options using the five families above. For each, specify meters, caps, rollovers, and platform fees.

- Pressure test with finance for margin and sales for forecastability.

- Pre-write the change narrative for customers. Simplicity and fairness must be obvious.

Weeks 5–6: Customer validation

- Interview 10–15 current customers and 5–10 prospects. Show two models side by side and listen for trust, predictability, and fairness.

- Align on a single primary model and a fallback model for specific segments.

Weeks 7–10: Pilot and measure

- Launch to a limited segment or new deals only.

- Implement spend caps and in-product usage alerts.

- Track unit economics weekly. Compare win rate and average selling price to prior cohorts.

Weeks 11–12: Decide and scale

- If KPIs hold or improve, plan the migration for existing accounts at renewal with grandfathering where needed.

- Publish a clear pricing explainer with examples, calculators, and overage rules.

Ongoing: Build toward value-based

- Add in-product measurement that links metered actions to outcomes.

- Experiment with outcome-based contracts where the four conditions apply.

- Review KPIs after each change and document learnings.

If you get this right

Margins improve as usage grows because price tracks cost drivers. Upsell happens naturally as teams adopt more value-creating actions. Sales gains confidence because bills are predictable and fair. Finance wins because ARR and gross margin rise together. Customers feel aligned because they pay more only when they get more.

Final takeaway

Pricing is not a table you publish. It is a system you operate. In AI, that system has to meter real cost drivers, point to real outcomes, and change fast as your product evolves. Follow Kyle’s six rules to move from guesswork to discipline, from margin surprises to value capture, and from experimental AI features to a profitable AI business.

🎥 Watch Kyle’s full session from SaaSiest Amsterdam here