The Problem: Scaling Fast Is No Longer Enough

In the era of cheap capital, fast growth was the holy grail. Today, profitable growth is the new gold standard. With tighter funding environments, investor expectations shifting, and the cost of inefficiency rising, scale-up leaders are being asked to do more with less — and to do it smarter.

So how do you move from “growth at all costs” to growth that sustains? Frederic Laziou, CEO of Puzzel, offers a playbook at SaaSiest 2025 forged through experience: scaling a customer experience platform across Europe, driving 87% revenue growth in four years, and reaching a 23% EBITDA margin — all without sacrificing strategic ambition.

This is his blueprint for building a high-performance SaaS company where growth and profitability go hand in hand.

Frederic Laziou is a three-time CEO who has led four acquisitions in three years, scaled Puzzel from €40M to €75M ARR, and transformed it from a Norwegian point-solution vendor into a multi-product European platform.

He’s lived the painful trade-offs, the complexity of integrations, and the reality of running lean. His lessons aren’t theoretical — they’re tactical, tried, and tested.

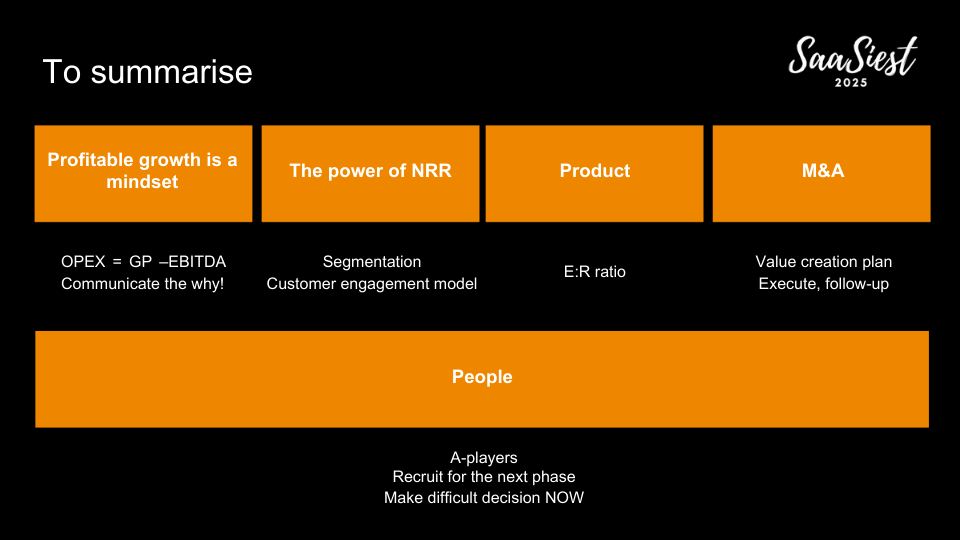

The 5 Levers of Profitable Growth

1. Profitable Growth Is a Mindset Shift

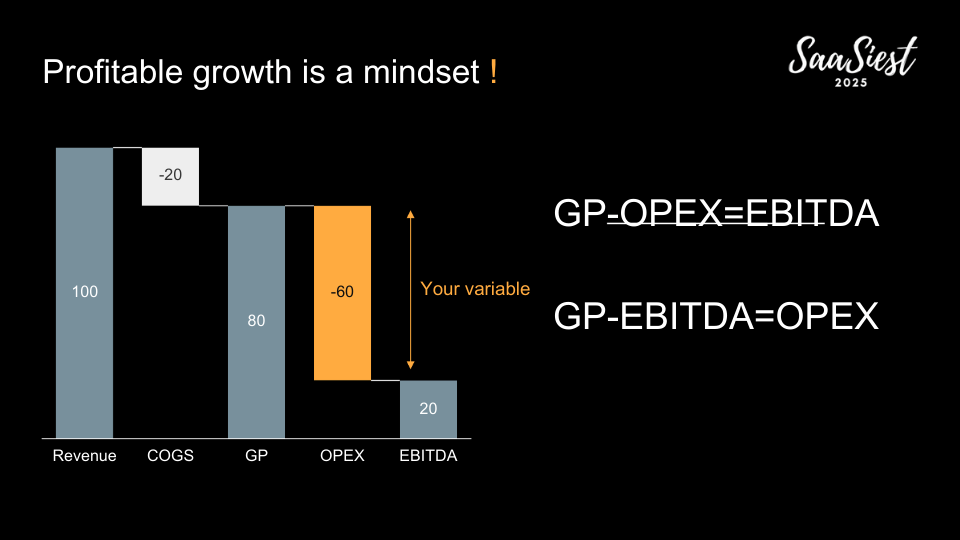

Most companies treat EBITDA as an output. Frederic challenges that. “Your real variable isn’t EBITDA. It’s your OPEX,” he says.

At Puzzel, the team set a very clear target: 20% topline growth with 20% EBITDA. But it wasn’t just a financial target—it set the tone for how the whole business would operate. They spent time selling the “why” internally: profitability meant owning their own destiny, not relying on future funding rounds.

Actionable takeaway: Treat profitability as a constraint at the start of planning, not the end. If you’re not growing 50%+ annually, you can’t invest in everything. Pick your bets and align your OPEX accordingly.

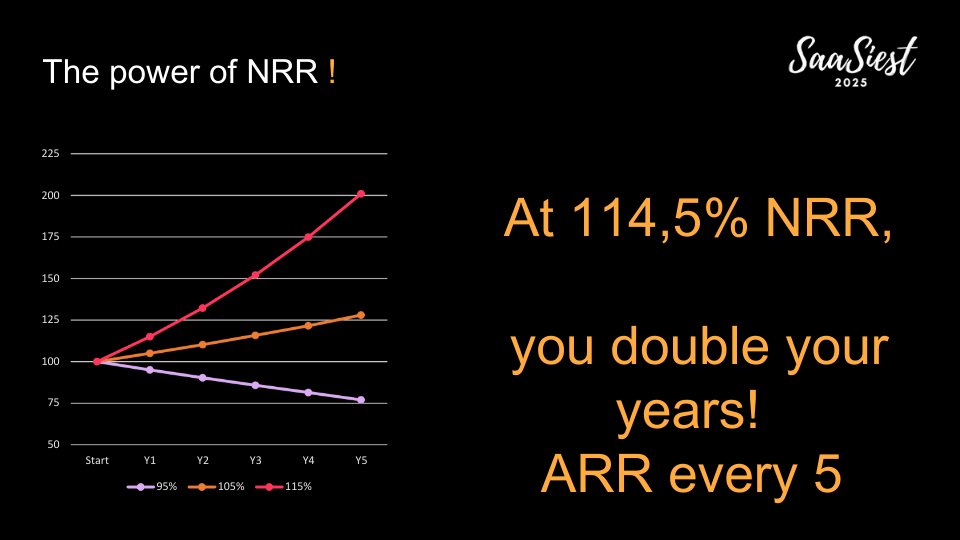

2. Master Net Revenue Retention (NRR)

The compounding effect of NRR is undeniable. Puzzel modeled the difference between 95%, 105%, and 115% NRR: over five years, 115% more than doubles your base. 105% only grows it by 26%.

To unlock this lever, Puzzel:

- Built clear customer segmentation based on ARR and growth potential

- Created differentiated engagement models by customer tier

- Evolved packaging to ensure upsell opportunities (vs. selling the “full Monty” day one)

Actionable takeaway: Audit your current NRR strategy. Are your accounts segmented? Is your packaging built for expansion? Are CS and Sales aligned on potential vs. revenue today?

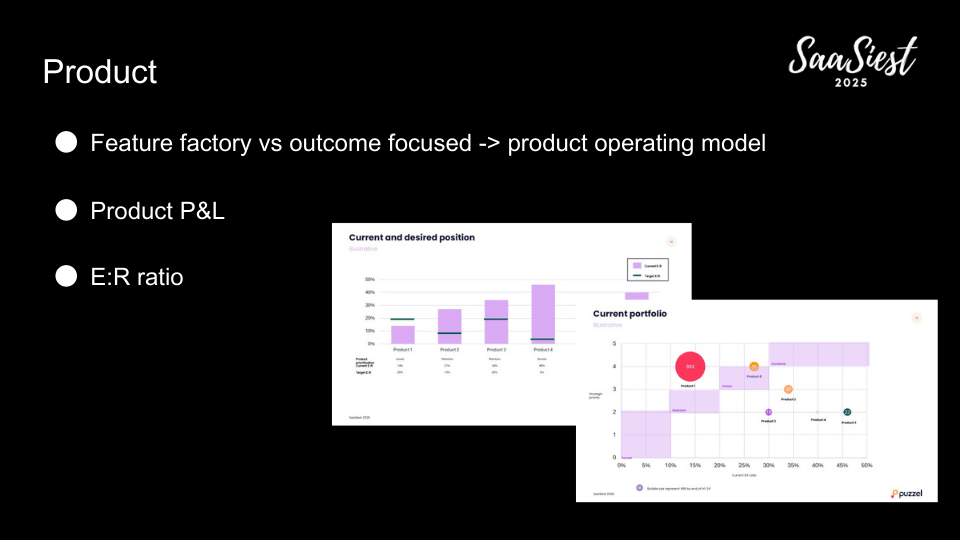

3. Product Investment Should Follow a Portfolio Strategy

In Puzzel’s earlier days, product roadmaps were driven by whoever shouted the loudest. That changed.

Frederic implemented product P&Ls, mapping each feature or product by:

- Revenue generated

- R&D spend

- Strategic importance

The result was a clear view of where they were over-investing or under-investing. Non-strategic products with high spend were dialled down. Strategic bets were protected.

Actionable takeaway: Build a product P&L. Even if you’re single-product, evaluate features by ER ratio (Expense-to-Revenue). Use a portfolio map to reallocate resources accordingly.

4. Use M&A as a Profit Driver — Not a Distraction

Puzzel executed four acquisitions in three years. The key to making them accretive? A value creation plan before the deal closed.

Each acquisition was mapped against:

- Strategic vision & rationale

- Governance model

- Quick wins (revenue or cost synergies)

- 5 core integration workstreams (GTW, product, people, systems, legal)

Their most recent deal with Capturi added €1.6M in ARR in four months and delivered €2M in identified cost savings. None of it happened by chance.

Actionable takeaway: Never enter M&A without a pre-defined integration and value capture playbook. Your job isn’t to buy—it’s to extract value fast.

5. People: The 10x Lever

According to Frederic, the difference between an A-player and a B-player isn’t 2X—it’s 10X.

He advises:

- Make changes early if someone isn’t a fit; it rarely gets better

- Hire people who’ve seen profitable growth before

- Create space for growth mindset and curiosity while staying focused on execution

He even uses a personal exercise: every 12 months, he “fires himself” mentally, challenging old assumptions and reviewing the business with fresh eyes.

Actionable takeaway: Build a team not just for now but for the next chapter. Prioritize proven operators who know how to navigate the shift from growth to profitability.

The Payoff: Autonomy, Optionality, and Control

When growth is smart and profitable:

- You’re not reliant on external capital

- You can take calculated risks without fear of failure

- You attract better talent, better customers, and better acquirers

In Puzzel’s case, that meant jumping from single-digit margins to 23% EBITDA while expanding across multiple countries and products.

Final Word

“It’s not rocket science. But it is hard work,” Frederic concludes.

Profitable growth isn’t the absence of ambition. It’s ambition with discipline. For every SaaS leader navigating the next stage of scale: revisit your mindset, re-evaluate your product bets, and above all, hire for where you’re going.Because as Frederic puts it: “If you know you need to make a change, do it now. It won’t get easier in six months.”

Watch Frederic’s full session at SaaSiest 2025 here