Scaling SaaS in Europe: the real challenge

Expanding a SaaS company across Europe looks simple on a strategy slide. But once execution starts, leaders face fragmented regulations, inconsistent tax laws, and costly localization demands that slow growth and drain efficiency.

For Mollie, one of Europe’s leading payment service providers, this complexity became both a problem and a competitive advantage. Their journey from a Dutch startup to a profitable pan-European fintech wasn’t linear — it was built on lessons that turned operations into strategy.

At SaaSiest Amsterdam 2025, Rogier Schoute, Chief Product Officer and board member at Mollie, shared how the company achieved scalable localization, restored profitability, and built a new growth engine through embedded payments — lessons every SaaS operator can apply.

1. Localize at scale — and make it your competitive advantage

For its first 12 years, Mollie stayed local. “We called it the European disease,” Rogier recalled. “Being happy with your own market.”

When they finally expanded beyond the Netherlands, the team discovered just how fragmented Europe truly is. “Localization isn’t translation,” Rogier said. “Every market has unique tax rules, reporting formats, and compliance frameworks. Even when regulation looks harmonized on paper, it isn’t in practice.”

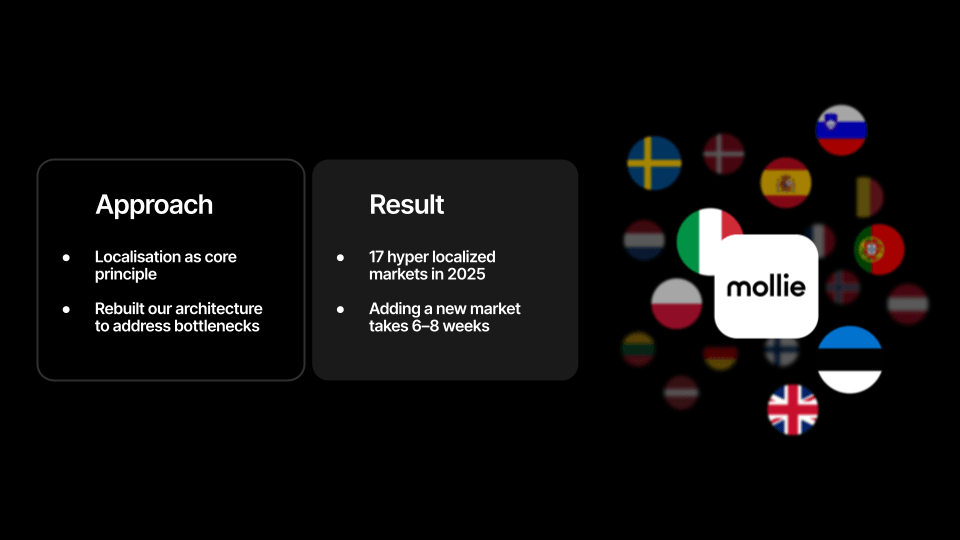

Mollie’s breakthrough came when they stopped treating localization as a one-off project and rebuilt their architecture so that localization became a system capability. Every team could adapt its part of the product, and launching a new market turned from a development cycle into a configuration exercise.

This structure allowed Mollie to launch a fully localized market in 6–8 weeks — including payment methods, onboarding, and KYC/AML processes. That operational agility became one of the company’s defining advantages.

If your SaaS business depends on local adoption, scalability starts in your systems. True localization isn’t a checklist — it’s a company muscle.

2. From hyper-growth to sustainable, profitable growth

Between 2019 and 2021, Mollie was thriving. COVID-driven e-commerce growth sent transaction volumes soaring. Fintech investment hit record highs. But as Rogier recalled, “Even while we raised money at a great valuation, our execution slowed. We had over-hired and over-organized.”

When the market normalized, inefficiency hit hard. The solution wasn’t more people — it was operational efficiency and automation.

Every team was given KPIs to reduce the cost of doing business — from customer onboarding to support interactions. Manual work had to be automated. Complexity had to be removed.

But efficiency didn’t mean removing the human touch. Mollie mapped every customer contact reason back to the responsible team, set improvement goals, and — unlike many fintechs — made their support more accessible.

“In financial services, trust is everything,” Rogier said. “If people want to call you, they should be able to. Making support easier to reach actually forced us to become more efficient.”

The results speak for themselves: Mollie turned a €73 million annual burn in 2021 into profitability, tripled growth, and increased customer satisfaction scores across Europe.

Their formula: automate for scale, but stay human for trust.

3. Disrupt yourself before the market does

Even as performance improved, the payments landscape changed again. The power dynamic shifted from merchants to SaaS platforms embedding payments directly into their products.

“Fifteen years ago, merchants chose their payment provider,” Rogier explained. “Now, their software platform does. That changed everything about distribution.”

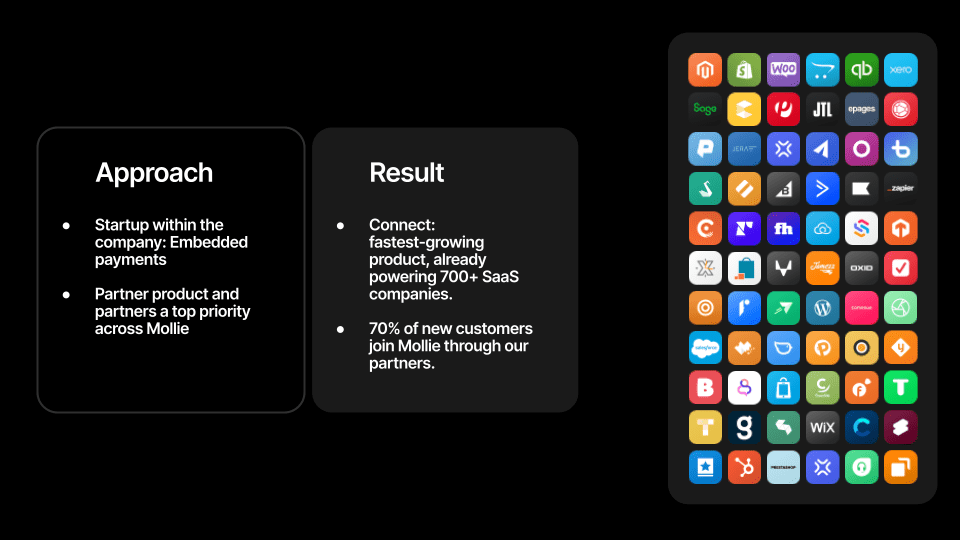

Rather than react, Mollie disrupted itself. The company created an internal startup — Embedded Payments — to focus exclusively on serving SaaS platforms. “When something big is happening, don’t spread it across the organization,” Rogier said. “Keep your core business running and dedicate a focused team to build the future.”

Instead of copying global competitors, Mollie built on its strengths: high-quality APIs combined with a managed-service model that handled risk, fraud, and customer support. This approach appealed to SaaS platforms that wanted payment capabilities but not the operational overhead.

The result was Mollie Connect for Platforms, now the company’s fastest-growing product, powering embedded payments for more than 700 SaaS businesses across Europe.

When disruption hits, differentiation matters more than imitation. By combining operational excellence with a bold product bet, Mollie turned a looming threat into its next growth engine.

The new SaaS growth formula

Rogier’s experience at Mollie offers a blueprint for SaaS leaders scaling across complex markets:

- Build localization into your architecture from day one.

- Make efficiency and customer experience measurable for every team.

- Balance automation with humanity to strengthen trust.

- When your market shifts, disrupt yourself on purpose.

“When operations become strategy,” Rogier concluded, “you stop treating efficiency as an afterthought. It becomes how you compete.”

🎥 Watch Rogier’s full session at SaaSiest Amsterdam 2025 here