What’s the problem?

Pricing remains one of the most overlooked levers for SaaS growth. And when it’s time to raise capital or prepare for an exit, it’s often where the biggest gaps — and the most missed revenue — show up. Too many companies enter investor due diligence without a clear pricing strategy, consistent discounting, or even basic documentation. That’s a credibility risk. One that can affect both valuation and deal velocity.

Why now?

Capital is tight. Efficiency expectations are high. SaaS leaders are expected to show not just growth, but control. Pricing is a big part of that. The good news? As Kristoffer Cedfors, Senior Director of Commercial Excellence at Verdane, shared at SaaSiest 2025, the common issues are easy to identify and often quick to fix.

Meet Kristoffer Cedfors

With more than 15 years in pricing, Kristoffer has worked across industry, consulting, and private equity. Today, he supports companies in Verdane’s Northern European portfolio, helping them strengthen commercial strategy, improve pricing models, and prepare for transactions.

At SaaSiest, he outlined the five most common pricing faults he sees in growth-stage SaaS companies. Each one can be addressed without a full transformation project. Often, it’s about doing the basics better.

The Five Pricing Faults to Fix

1. No Documented Pricing Strategy

This doesn’t mean a price list or a one-pager of discount rules. A proper pricing strategy aligns with your business model and customer segmentation.

Kristoffer sees many companies describing themselves as “premium,” yet still undercutting the competition to win deals. Without a defined strategy, investors question your understanding of the market and your ability to defend margin.

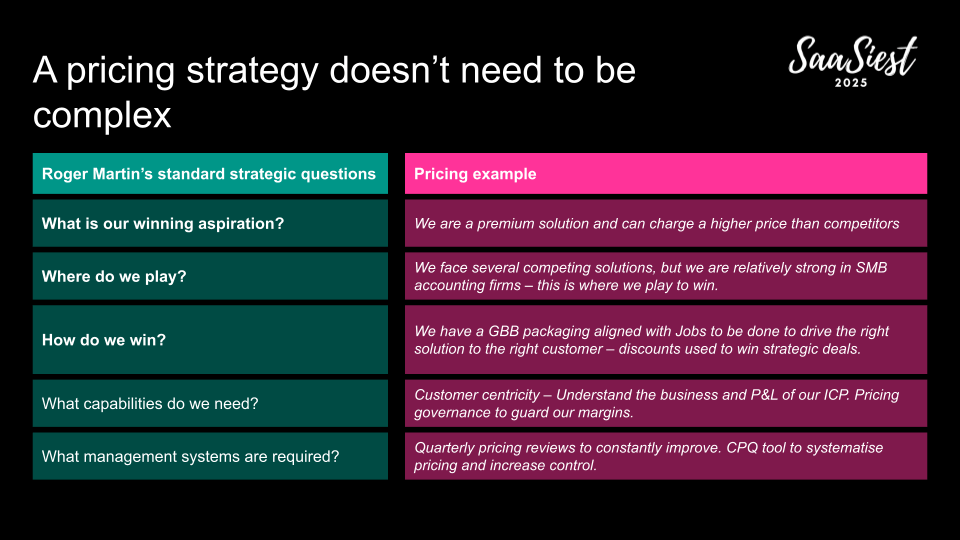

What to do: Start with Roger Martin’s “Playing to Win” questions:

- What are we trying to achieve with pricing?

- Where do we compete?

- How do we win in those segments?

- What capabilities do we need?

- What systems or processes will support this?

Clarity here builds confidence. It also sets the foundation for the rest of your pricing work.

2. No Formal Pricing Forum

Pricing is often treated as a static exercise. Once set, it’s rarely revisited. There’s no regular meeting, no shared ownership, and no feedback loop from sales or customers.

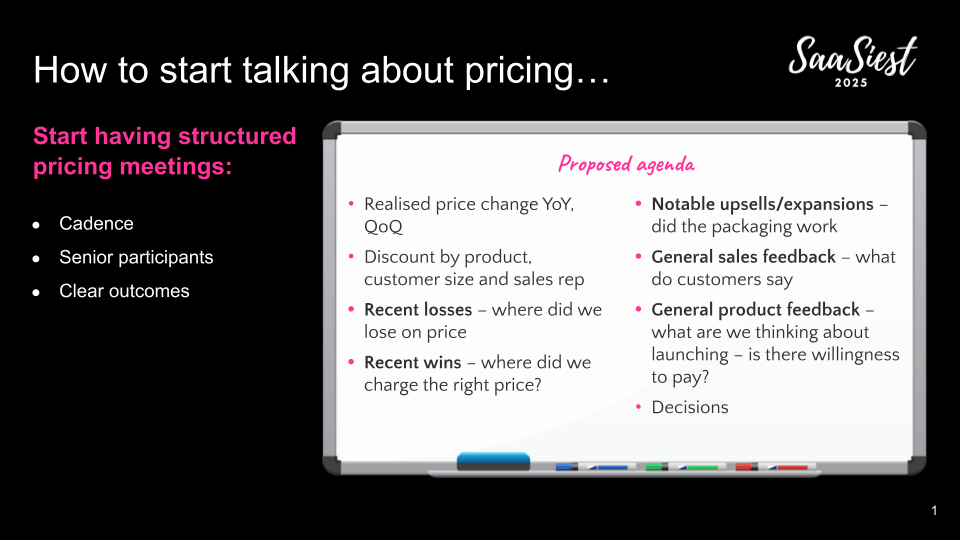

Fix it by setting a regular review cadence. Monthly or quarterly, depending on deal volume. Make sure senior decision-makers are in the room, and use a structured agenda:

- Recent wins and losses: where did pricing help or hurt?

- Discount patterns: by product, segment, or sales rep

- Expansion deals: is the packaging working?

- Sales and product feedback: is there willingness to pay for what’s coming?

Make pricing a living process, not a one-off decision.

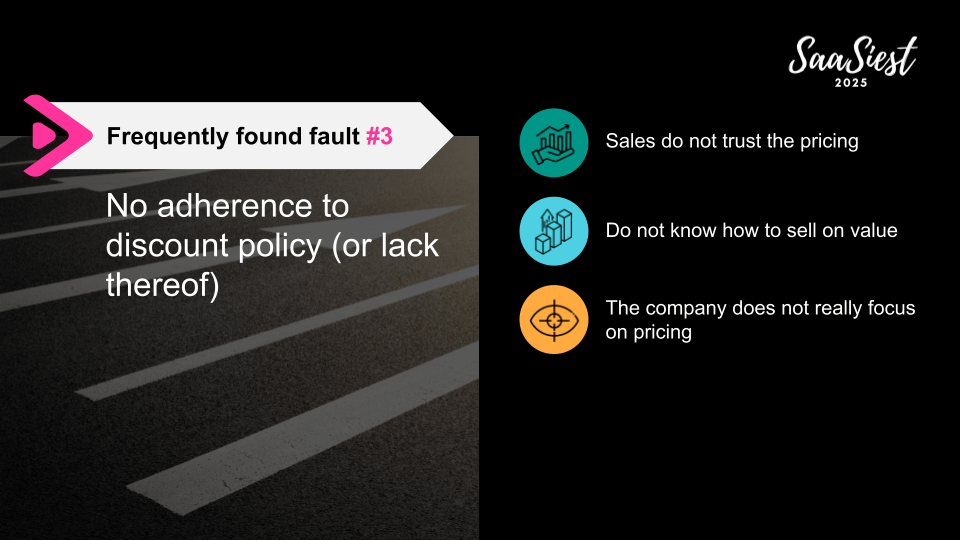

3. No Discount Policy or Adherence

This one shows up clearly in data. Kristoffer often runs a realised price analysis—price paid versus volume purchased—and sees huge inconsistencies. Two customers buying the same thing, but at wildly different prices.

It’s not just about fairness. It signals lack of control.

To tighten things up:

- Define discount boundaries by customer type, volume, or deal size

- Require a clear exchange: multi-year contracts, case studies, logo usage

- Use tools like CPQ to help sales stay within guardrails

- Align compensation to reinforce the right behaviour

When sales teams understand value and have the tools to defend it, discounting becomes intentional, not automatic.

4. No History of Price Increases

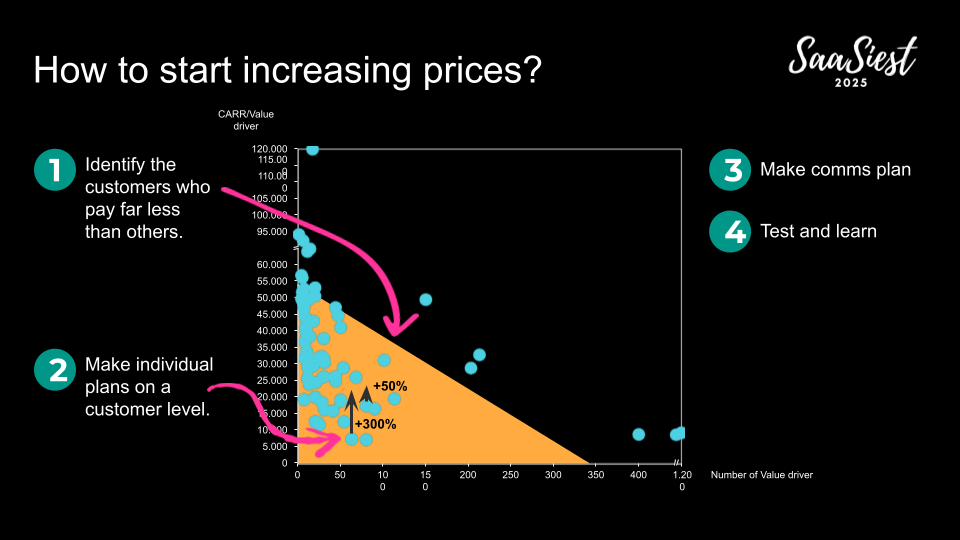

Legacy customers often remain on year-one pricing because no one revisits them. You lose margin and miss valuable pricing insights, like elasticity and willingness to pay.

Start simple:

- Identify customers who are far below average in price

- Build account-specific increase plans

- Tailor your messaging; some increases require a call, others just an email

- Test and refine your approach

A spreadsheet is all you need to start. Price increases don’t have to be across the board. Small, thoughtful steps make a difference.

5. No Price Indexation in Contracts

It’s surprisingly common to find SaaS contracts that still don’t include annual price adjustments. That means margin erosion over time and no built-in ARR growth.

The solution: Include indexation in all new contracts and update legacy agreements when renegotiating. Even a basic inflation clause helps create a more durable business model.

Why This Matters

When you improve pricing discipline, you gain more than revenue. You strengthen your position in investor conversations, build sales confidence, and increase customer clarity.

Most importantly, you show that pricing is a strategic lever, not a tactical afterthought.

Final Takeaway

Kristoffer closed his keynote with a light-hearted “pricing oath,” but the message was clear. SaaS companies must treat pricing with the same strategic importance as product and go-to-market.

If you’re scaling, fundraising, or preparing for exit, now is the time. Fix the five faults. Align your pricing. And walk into your next board meeting with confidence.

Check out Kristoffer’s session at SaaSiest 2025 here