Lemlist is a bootstrapped B2B SaaS that hit a wall after racing from 1M to 14M ARR in two years with strong profitability. Then growth stalled. In 2023, Charles joined, and the team went back to first principles. By September 2025, ARR climbed to roughly 35M with profitability intact.

When acquisition no longer outpaces churn, ARR flattens. That is the spreadsheet view. Underneath it is a system problem. Patchwork fixes rarely work. You need to diagnose and redesign the system.

Lemlist made five big shifts. This is the playbook they used to break the plateau.

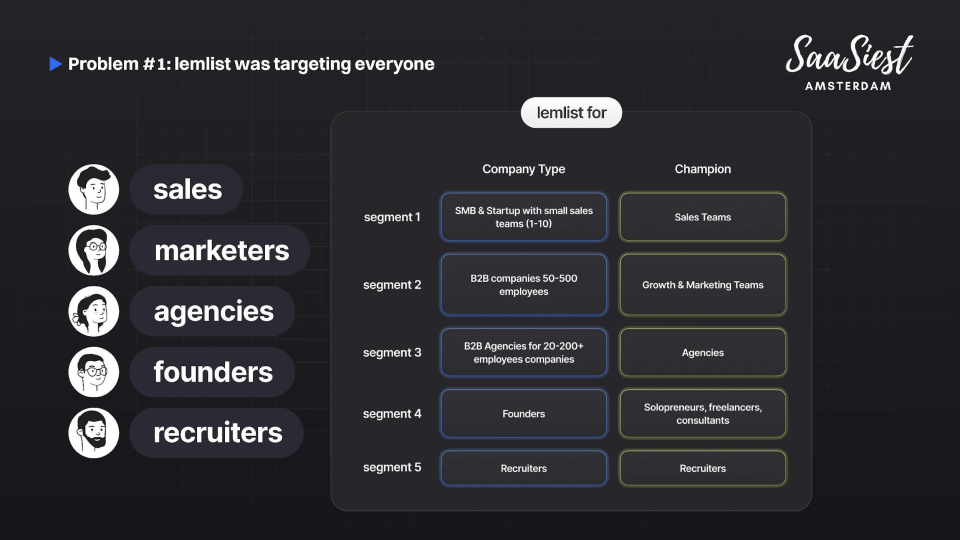

1) Pick one primary customer and commit

Problem: The product served five personas at once. Sales, marketers, founders, agencies, recruiters. Feedback conflicted. Roadmap drifted. Churn was elevated in founder-led accounts.

Shift: Choose a primary ICP. Lemlist is committed to sales teams. Think small teams first, then scale up. Keep legacy segments alive, but stop letting them drive the roadmap.

Why it works: Focus compounds. Messaging tightens, demos sharpen, onboarding shortens, engagement deepens, and expansion gets easier.

Signals you are doing it right

- Clear persona hierarchy documented on one page

- Discovery, messaging, pricing, and packaging are mapped to the ICP

- Backlog tagged by persona and percentage of effort aligned to the primary ICP

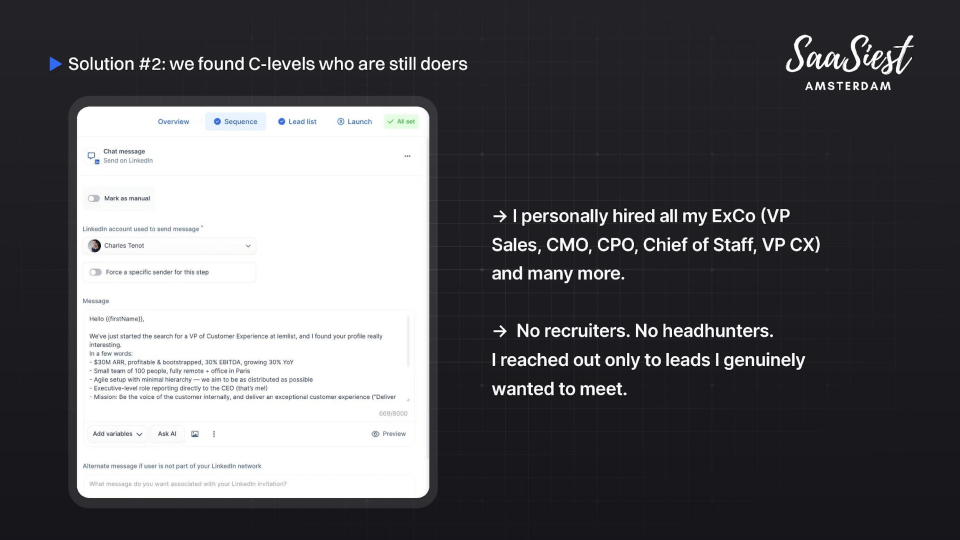

2) Upgrade the team without losing “doer” DNA

Problem: A culture of junior doers shipped volume, but leadership capacity and cross-functional execution lagged.

Shift: Hire senior operators who still love the craft. Charles sourced execs himself, looked for hands-on evidence, and set the tone with values like “no babysitting” to filter for ownership.

Why it works: Senior doers raise the bar on speed and quality. They manage systems, not slides. They cascade standards and unblock squads.

Interview tells

- Concrete “last feature shipped” stories with user discovery, trade-offs, edge cases

- Specifics on deals personally worked, campaigns personally built, and incidents personally resolved

- Discomfort with being a coordinator only

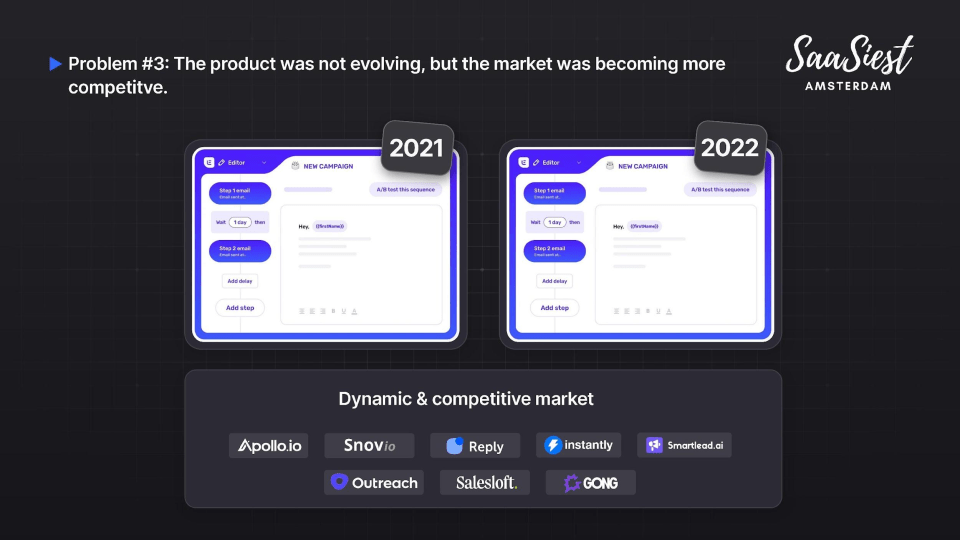

3) Restart product innovation so distribution has something to talk about

Problem: A year focused on tech debt slowed visible innovation. The market stopped seeing Lemlist as an innovator. Sales said, “The product is not moving.” Leadership said, “Sales is making excuses.”

Shift: Senior product owners with one mission each. Small autonomous squads. One vision. Clear scope. Measurable outcomes. Ship value often.

Why it works: Product velocity feeds distribution. New capabilities refresh narratives, create partner buzz, and unlock expansion paths. Stalled product today shows up as stalled revenue a year from now.

Cadence to aim for

- Monthly visible value drops

- Quarterly narrative moments that customers can rally around

- Annual step-changes that reset competitive positioning

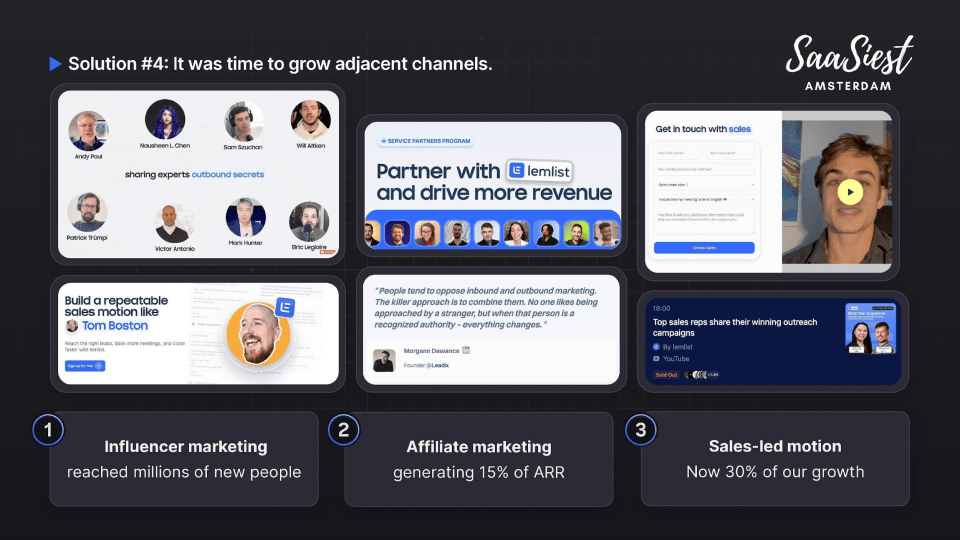

4) Diversify growth motions

Problem: One primary channel. Heavy dependence on a few personal brands. When they paused, the pipeline slowed.

Shift: Keep PLG. Add sales-led. Layer influencer partnerships and affiliate. Court creators who truly use the product. In the latest quarter, a meaningful share of new ARR came from sales-touched deals alongside PLG.

Why it works: Channel concentration is a hidden risk. Multiple, adjacent motions de-risk growth and multiply reach. PLG and SLG can lift each other.

Practical buildout

- Influencer: enable a shortlist with early access, assets, and rev share

- Affiliate: simple tiers, fast payouts, co-marketing calendar

- SLG: target lists from product signals, fast qualification, crisp demo path, clear handoffs back to product-led expansion

5) Protect talent density

Problem: As headcount grows, tolerance for “okay” performance creeps in. High performers notice. Standards drop.

Shift: Rate every role against the current bar. Retrain, reassign, or part ways. Optimize for courage and clarity. Preserve a small, sharp team.

Why it works: Velocity, judgment, and ownership are multiplicative. One misfit in a critical loop slows everyone.

Ground rules

- If you would not rehire that person for this stage today, act

- Move first on roles that bottleneck others

- Replace vague kindness with precise candor and support

The system view

All five shifts reinforce each other.

- Focused ICP reduces complexity, which increases product velocity.

- A better product gives marketing and partners a story, which lowers CAC.

- PLG plus SLG increases acquisition and expansion, which lifts NRR.

- Senior doers and talent density raise execution across the loop.

That is how a flat line becomes an upward slope again.

Your 30-60-90 day plan

Days 1–30

- Write the one-page ICP hierarchy and win thesis

- Tag the backlog by persona and value driver

- Map the current pipeline by channel and dependence risk

- Start talent density review with objective scoring

Days 31–60

- Stand up one sales-touched motion on top of PLG

- Recruit two senior doers for the highest leverage gaps

- Launch one creator partnership and one affiliate cohort

- Ship two visible product improvements tied to core ICP use cases

Days 61–90

- Publish new packaging and demo path for the primary ICP

- Run the first AB test on pricing or usage limits for stickiness

- Set monthly product narrative drops and quarterly step-change goals

- Close the loop with the weekly growth council across product, sales, and marketing

Metrics to watch weekly

- Signups and PQLs from the primary ICP

- Activation rate by ICP and by channel

- Sales-touched pipeline created and win rate

- NRR by cohort and feature adoption leading indicators

- Time to first value and time to expansion

- Creator and affiliate influenced signups and revenue

Pitfalls to avoid

- Serving five personas because you fear near-term revenue loss

- Hiring senior “managers of managers” who do not touch the work

- Treating tech-debt months as reasons to pause user-visible wins

- Betting your quarter on one channel or one person’s brand

- Keeping “nice” but misaligned players and hoping it works out

The takeaway

Breaking a plateau is not a growth hack. It is a system redesign. Pick one customer to win, staff the team with senior doers, ship value on a drumbeat, diversify go-to-market, and fight for talent density. Do that for three quarters, and your spreadsheet will catch up to the story.

Watch Charles’s full session from SaaSiest Amsterdam 2025 here: https://saasiest.com/how-lemlist-broke-the-growth-plateau-our-five-lessons-to-re-ignite-growth/